- About

-

Business Advice

- 20 Questions

- Advertising Branding & PR

- Communications

- Company Culture

- Customer Service

- Editors Notebook

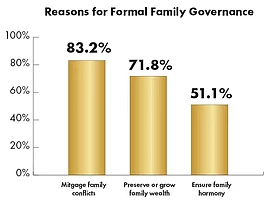

- Finance & Succession Planning

- Fleet Management

- Health & Human Resources

- Industry Events

- Leadership

- Legal

- Management

- Publisher's Page

- Sales & Service Agreement

- Strategy

- Tops in Trucks

- Training & Education

- Industry Resources

- Subscription Center