Editor’s Note: Due to the unprecedented situation we are finding ourselves in with COVID-19, Ruth King is suspending the Rules of Wealth and writing about actions that can help you survive these times and prepare for the future. This is Part 3 of How to Salvage 2020 Profitability. Once this pandemic is over, she will resume the rules of wealth series.

Financials start with first understanding cash flow, then creating a revised profit and loss statement, then creating a cash flow budget. In the first segment of this series I started with cash is now emperor rather than just king. It is critical to monitor profitability and cash.

What is Cash Flow?

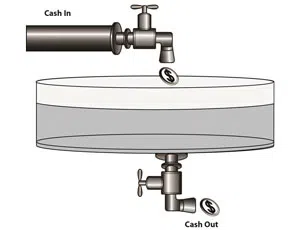

Look at the figure and you see a spigot on top and a drain out the bottom. In between is the tank of water. Assume the tank holds money instead of water.

There is a certain level of money in the tank when you start the day, the week, the month or the year. Let’s assume you are tracking cash on a weekly basis.

You open the spigot and you get cash in. How do you get cash in? Well, it’s not from sales, it’s from the collections of those sales. You could send Mrs. Jones an invoice and if she doesn’t pay you for 30 days, it’s a sale, but you don’t get the cash.

The cash is really, really, really important. So, you get cash from collections on sales and you get a little bit interest, on your savings account, which is good. And you might get some cash from your line of credit or you might sell an asset.

These are the major ways you get cash in the door. The level of money in the tank rises.

Then you open up the drain to pay your bills, payroll, rent, etc. Money drains out of the tank. There has to be some money left in the tank at the end of the week.

Then the process starts over again. That’s cash flow.

There always has to be at least a drop of cash in the tank at the end of the time period. That’s why negative cash on your balance sheet is not real.

Create Revised P&L

This should probably be a realistic view of what you want to happen for the rest of 2020. You need to create your updated P&L to show at least a few dollars of profit at the end of the year.

A net profit per hour equal to what you can earn at a fast food restaurant should be the lowest net profit you should budget for.

Create Cash Flow Budget

Your cash flow budget is dependent on your profit and loss budget. For example, residential service is COD. You receive the cash in the same month that you do the work. You pay the technicians the same month as you do the work. You probably pay your suppliers the following month. So, collections on revenue and labor expense go in the same month. Supplier payment for that work goes in the following month.

Commercial service is generally not COD. If you do work in one month you probably will get paid the following month or later depending on your average receivable days. If your receivable days are 45 days, that means that it is 45 days from the time you send out an invoice to the time you get paid.

So, if you do the work in January and it is billed before January 15, you will receive payment for that work in February. Bills sent after January 15 will, on average, be paid in March. Budgeted revenues on the profit and loss statement become collections 45 days later.

On the payment side, your direct expenses for equipment and material are generally due the following month from the purchase. Overhead expenses are generally paid the month that they are incurred.

You may prepay some expenses like insurance. That means, even though from an P&L perspective, the expense is 1/12 of the total, the cash outlay is the total amount paid in the month insurance is due. For example, if your liability insurance is $12,000 and it is due each August 1, then even though the monthly expense on the P&L is $1,000, your cash outlay will be $12,000 on August 1.

Like the first time you read a wiring diagram, the first time you create a cash flow budget might be a little frustrating. It will become easier and easier as you do it.

If you would like a copy of a sample P&L and cash flow budget, send me an email (ruthking@hvacchannel.tv).

You can survive and thrive after this pandemic. Make sure you have profitable sales, a strong maintenance program, save money and watch your cash!