Whether you are selling your business or passing it to the next generation, maximize the dollars you receive for your hard work over the decades. This series discusses what you need to do to get your business in shape to sell. Your company might be in perfect shape to sell or it might take a few years to get it in shape to sell.

Here are six musts to maximize your selling price:

1. You MUST have clean financial statements.

2. You MUST have inventory on your balance sheet.

3. You MUST have a thriving maintenance program.

4. You MUST prove that you have a profitable business.

5. Your business MUST NOT be dependent on you.

6. You MUST NOT have personal expenses as business expenses.

1. Clean financial statements

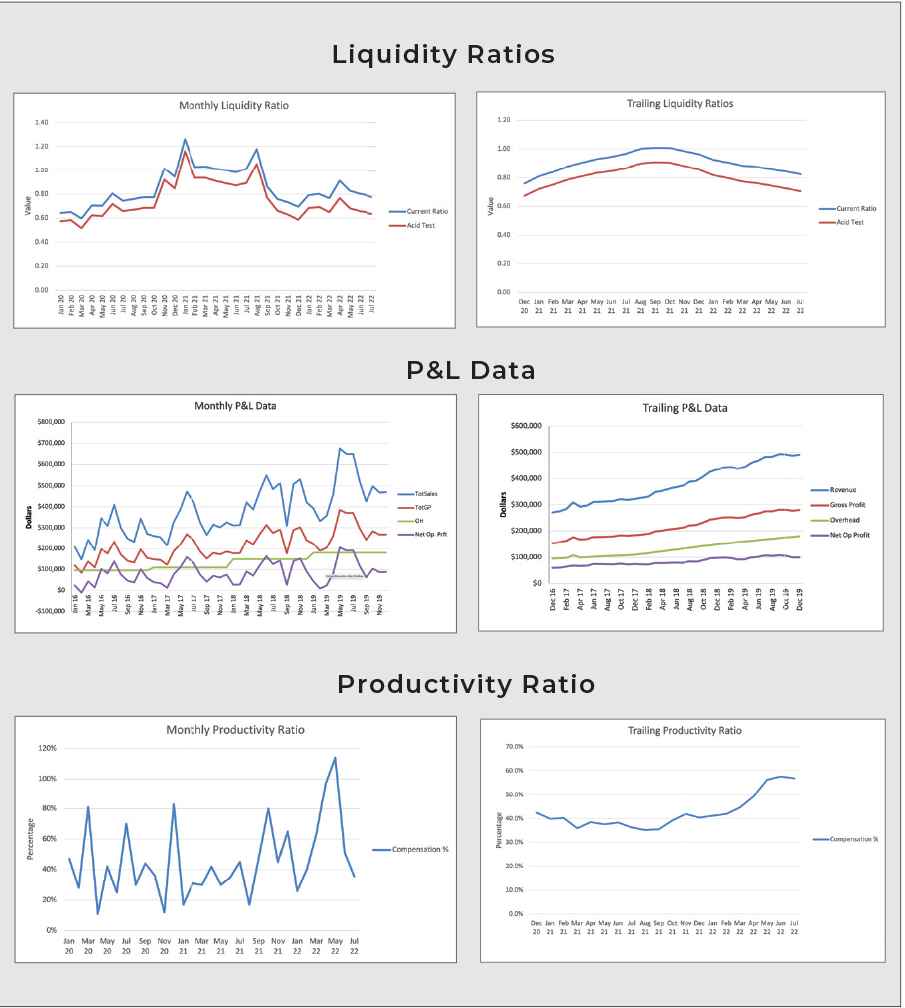

My research shows that 75% of all contractors’ financial statements are inaccurate. Before you sell, your business must be one of the 25% with accurate statements. The financial statements should be accurate for at least three years before the sale.

If your financial statements are inaccurate, a potential buyer will discount the information on them and ask for tax returns and other documents to prove the numbers on the statements. The value you receive for your business will be less with inaccurate financial statements because a buyer has to “guess.” I’ll give you the 12 major inaccuracies and how to correct them later in this series.

2. Inventory

If you don’t have inventory on your financial statements, your net profit is lower based on the amount of inventory you have. No buyer is going to tell you this. They will estimate the value based on the profits shown on your financial statements.

If you have $100,000 in inventory and you haven’t stated it on your balance sheet, then your company profits are lower by $100,000. While this might be a tax strategy that you discussed with your CPA, it is a terrible strategy if you want to sell your business.

Here’s why: $100,000 less in EBITDA (earnings before interest, taxes, depreciation, and amortization) translates to $400,000 to $600,000 less that you’ll receive for your business, assuming the valuation multiples are in the 4 to 6 range. Are you willing to take between $400,000 and $600,000 less for your company because you are too lazy or stubborn to put inventory on your balance sheet and accurately account for it?

3. A thriving maintenance program

It doesn’t matter whether your business is residential, commercial, plumbing and HVAC. If you want a high multiple of EBITDA for your business, you must have a thriving maintenance program with a renewal rate of 80% or higher.

Buyers want to know you have recurring revenues from customers who trust your company. They renew their plans (or are on monthly recurring billing) every year. Then, a buyer knows what he is purchasing and can be confident of receiving those revenues on a yearly basis.

Along with the thriving program, you must have deferred income on your balance sheet and a savings account for maintenance plan receipts. If your company accounts for maintenance receipts when they are received rather than when performing maintenance work, then the company revenues are higher than they should be. A buyer will discount revenues by the amount of the estimated work that is uncompleted.

If you can show that your company puts the money received for maintenance plans in a separate savings account and uses deferred income until you complete the work, then there won’t be discounts on revenue.

Be prepared for the buyer to hold back proceeds for maintenance work sold but not performed since the buyer is taking on the liability for performing the work. The deferred income and savings account show a precise amount of holdback rather than a “guess.”

Next month, I’ll write about the following three “musts.”

Ruth King has more than 25 years of experience in the HVACR industry and has worked with contractors, distributors and manufacturers to help grow their companies and become more profitable. Contact Ruth at ruthking@hvacchannel.tv or at 770-729-0258.