If your compensation percentage starts to increase, you’ve got a productivity problem

Over the past few months, I’ve written about liquidity ratios and debt ratios; helping you answer the questions, “Can I pay my bills?” and “Am I taking on too much debt?” This month, I’ll discuss compensation percentage, which will help you determine if your employees are productive.

The compensation percentage, or productivity ratio, measures how productive your employees are —the dollars spent on payroll and payroll taxes as compared to revenue generated. It’s calculated by dividing the total payroll, plus payroll taxes, by revenue or sales. Payroll is all compensation: field, office and officers.

Payroll taxes are FICA, Medicare and both state and federal unemployment. Worker’s compensation expenses, health insurance or any other benefits should not be included. Do include commissions, but not bonuses, because bonuses are given over and above the normal compensation out of the goodness of your heart — they’re not normal operations expenses.

The compensation percentage is the only ratio that’s calculated based only on your profit and loss statement. All other ratios are calculated using your balance sheet, or a combination of your balance sheet and profit and loss statement. Therefore, the compensation percentage is the only ratio you can departmentalize. The service department should have a compensation ratio less than 40 percent, replacement department less than 28 percent and new construction less than 20 percent.

In slower months, I’ve seen acompany’s compensation ratio as high as 110 percent. This means for every dollar taken in that month, $1.10 was spent just for payroll and payroll taxes. And that doesn’t include rent, utilities or other expenses. Needless to say, that is not a profitable month.

The best way to lower this ratio, and ensure your company doesn’t meet the same fate, is to have a great maintenance agreement base to generate work in the slower times of the year.

Like the liquidity and debt ratios, the trends are what are important. Monthly percentage compensation can vary greatly depending on the weather, however, you’ll find as your maintenance agreement base increases, your compensation percentage will not vary as widely.

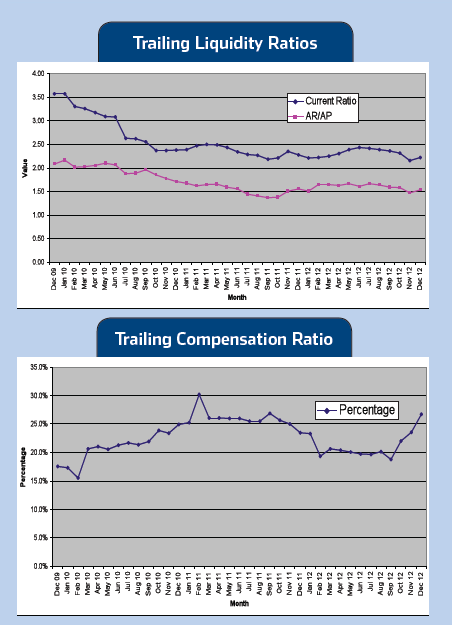

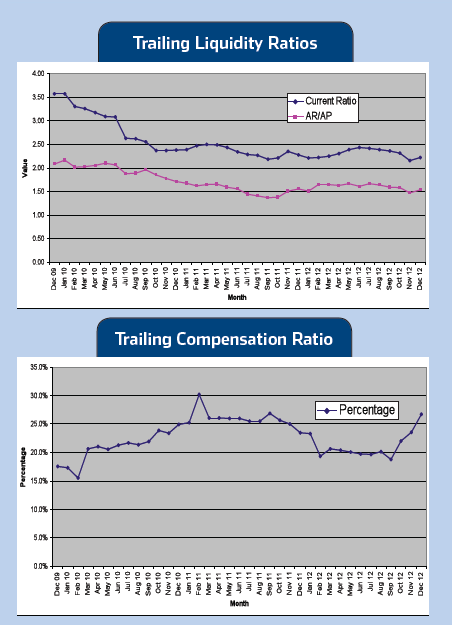

Even if your liquidity ratios are stable or showing increasing profitability, your compensation percentage may show a different story. As you can see in Figure 1, the liquidity ratios are stable for this particular contractor.They are starting to have a productivity problem, however, as seen in Figure 2 because the compensation percentage has been increasing significantly for the past four months.

If they don’t solve that problem, their profitability will suffer. In this case, the owner can spot and solve a seemingly minor issue before it causes major financial problems.

Keep your compensation percentage trend as low as possible. If it starts to increase, you’ve got a productivity problem you must solve to maintain profitability.

Ruth King is president of HVAC ChannelTV and holds a Class II (unrestricted)contractors license in Georgia. She has morethan 25 years of experience in the HVACRindustry, working with contractors,distributors and manufacturers to helpgrow their companies and make themprofitable. Ruth has authored two books: TheUgly Truth About Small Business and TheUgly Truth About Managing People. You cancontact Ruth at ruthking@hvacchannel.tv,or call 770-729-0258.