Find out how quickly you’re being paid and whether or not you’re being paid on time

Over the past few months I have written about the liquidity ratios, debt ratios and productivity ratio. This month looks at how quickly you are getting cash in the door. The Receivable Days ratio tells you whether you have a collection problem or are heading toward one.

The Receivable Days ratio, in conjunction with the Accounts Receivable to Accounts Payable ratio, lets you know how quickly you’re being paid and whether you’re being paid on time. It’s defined as the number of days from the time you send out an invoice to a customer to the time you receive payment from that customer.

The Receivable Days ratio is calculated from the Receivable Turns ratio. I don’t track turns because the critical ratio is the number of days. Receivable turns is calculated by dividing annualized sales by trade receivables or trade receivables plus cash.

Annualized sales are year to date sales times 12, divided by the month of the fiscal year covered by the calculation. For example, if your fiscal year end is December 31 and you’re calculating July’s annualized sales, take the total sales from January through July, multiply that number by 12 and divide it by 7 (July is the 7th month of your fiscal year).

Trade receivables are those receivables from customers. They don’t include employee receivables or owner receivables. Add cash to trade receivables when more than 50% of your business is COD.

Receivable days are calculated by dividing 365 by receivable turns.

Every residential contractor’s receivable days should be less than 30 days. Commercial contractors’ receivable days should be less than 50.

Even if your receivable days are less than 30 days, you still need to be vigilant. If they’re 18 days and they jump to 23 days, that’s an extra week it takes to get your money — which is significant. Find out why. It could simply be the service technicians are not collecting COD for all customers.

Receivable days also have a bearing on the Accounts Receivable to Accounts Payable (AR/AP) ratio. If receivable days are constant and the AR/AP ratio is increasing, that means increasing productivity. If receivable days are increasing and the AR/AP ratio is increasing, that’s another warning sign you have a collection problem.

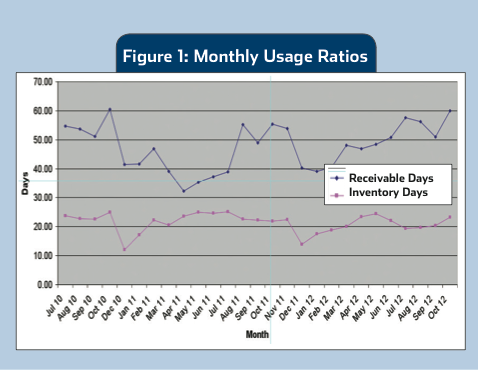

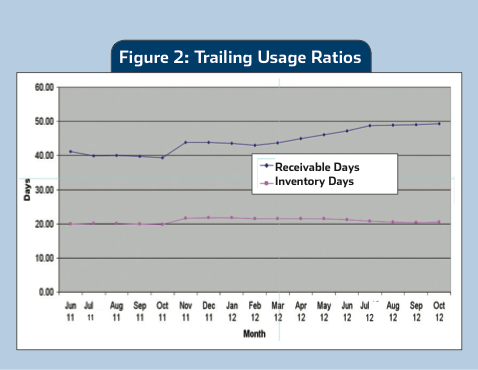

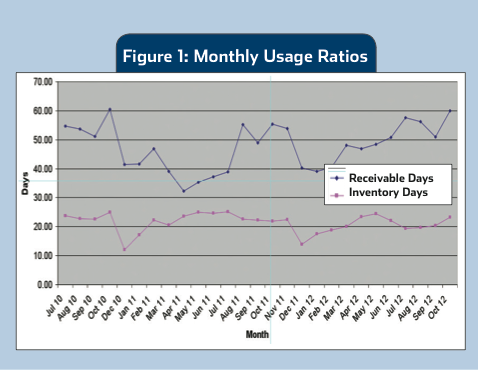

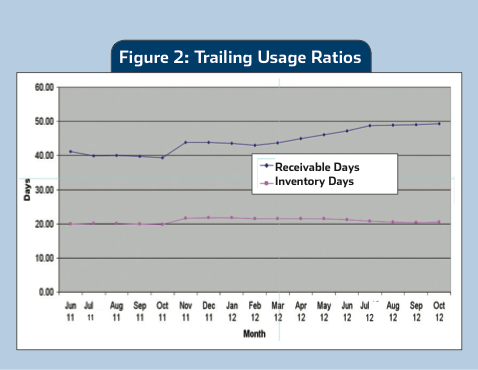

Like all of the ratios discussed previously, the trends are what’s important. Figure 1 shows monthly Receivable Days and Inventory Days (I’ll cover Inventory Days next month). It’s hard to tell what is happening with receivable days from this graph. Figure 2 shows trailing long-term receivable days. You can see the receivable days are slowly increasing which is a warning sign. They have increased from 40 to 50 days slowly over many months. This company has a long term collection problem. Fix it! Make the telephone calls on that 31st day, make sure your technicians are collecting on the job and make sure you send invoices the day that the work was done if you have to bill.

Ruth King is president of HVAC Channel TV and holds a Class II (unrestricted) contractors license in Georgia. She has more than 25 years of experience in the HVACR industry, working with contractors, distributors and manufacturers to help grow their companies and make them profitable. Ruth has authored two books: The Ugly Truth About Small Business and The Ugly Truth About Managing People. You can contact Ruth at ruthking@hvacchannel.tv, or call 770-729-0258.

Ruth King is president of HVAC Channel TV and holds a Class II (unrestricted) contractors license in Georgia. She has more than 25 years of experience in the HVACR industry, working with contractors, distributors and manufacturers to help grow their companies and make them profitable. Ruth has authored two books: The Ugly Truth About Small Business and The Ugly Truth About Managing People. You can contact Ruth at ruthking@hvacchannel.tv, or call 770-729-0258.

Ruth King is president of HVAC Channel TV and holds a Class II (unrestricted) contractors license in Georgia. She has more than 25 years of experience in the HVACR industry, working with contractors, distributors and manufacturers to help grow their companies and make them profitable. Ruth has authored two books: The Ugly Truth About Small Business and The Ugly Truth About Managing People. You can contact Ruth at

Ruth King is president of HVAC Channel TV and holds a Class II (unrestricted) contractors license in Georgia. She has more than 25 years of experience in the HVACR industry, working with contractors, distributors and manufacturers to help grow their companies and make them profitable. Ruth has authored two books: The Ugly Truth About Small Business and The Ugly Truth About Managing People. You can contact Ruth at