Investigate leasing and buying.

If only business equipment worked like good employees do: performing better with experience, requiring minimal amounts of attention, and never needing to be replaced. Unfortunately, this is not the case. Whether it is truck fleets, computer and phone systems, or other tools of the trade, there always seems to be equipment needs, regardless of the state of the marketplace.

Probably because of the economy, we are having more discussions with clients regarding the issue of equipment leasing versus purchasing. Those of you who are seasoned business owners would probably agree that this decision is often driven by your own personal philosophy and business judgment, as well as financial necessity. Those of you who take this approach probably share our agitation with writers and advisers who suggest that either leasing or purchasing is the “right” answer. There simply is no right or wrong approach.

With that in mind, this article will summarize the business, tax and other financial considerations associated with the lease-versus-purchase decision. Ultimately, only you can decide which approach is best for your business.

Types of Leases

Equipment leases generally are divided into two categories: financial leases and operating leases. Financial leases, which are the most common form of leases, are really financing tools. Typically, these leases are for a fixed term that does not exceed the useful life of the equipment, are not cancelable, transfer ownership of the equipment to the lessee at the end of the term, and require the lessee to pay for insurance, maintenance, and the like while the lease is in place.

Operating leases typically do not involve a transfer of the property to the lessee at the end of the lease term. Frequently, these leases do permit termination under certain specified conditions.

Tax Consequences

The tax consequences of purchasing a piece of equipment are very straightforward. Business equipment may be depreciated over its useful life. The Internal Revenue Code defines the “useful life” of business equipment based on the type of equipment. Currently, the Internal Revenue Code includes a number of provisions designed to spur the economy. Thus, it is presently possible to write off the cost of up to $125,000 of new business equipment as a current expense under Section 179 of the Code. Alternatively, it is possible to take accelerated depreciation.

Generally, lease payments are deductible as a business expense. There are IRS regulations that permit the IRS to treat a lease as a purchase agreement in some circumstances. However, given the tax incentives associated with purchasing equipment, this no longer appears to be a significant issue for the IRS.

Other Considerations

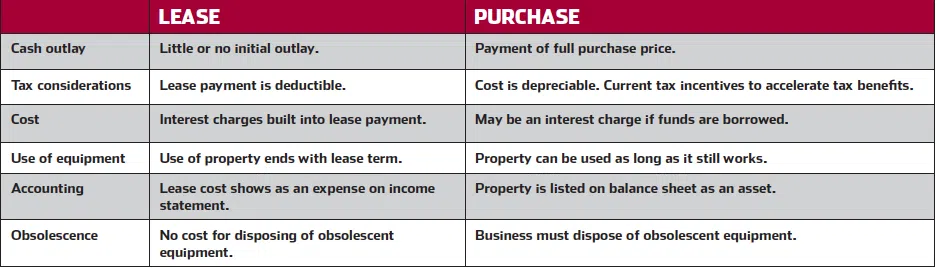

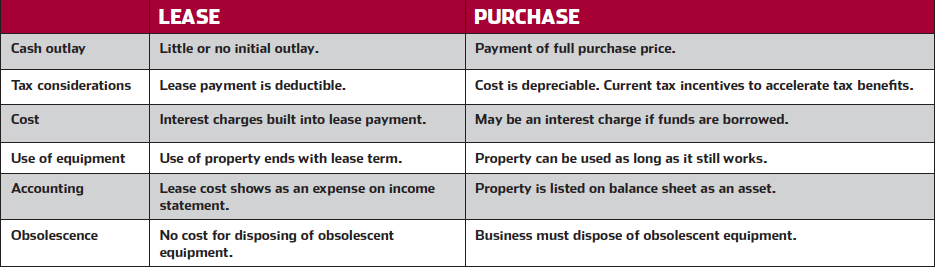

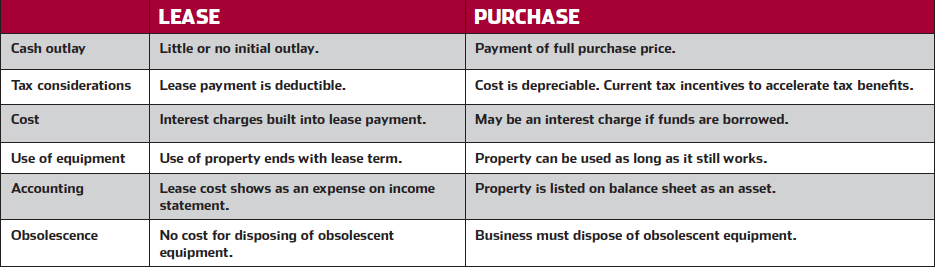

Above is a quick summary of the financial and other considerations typically associated with the lease versus purchase decision.

One final thought — in the current environment, your lease-versuspurchase decision may have to take into consideration your company’s existing banking relationship. Many banks are reducing business lines of credit, particularly if they are not regularly used. It may be important to lease equipment in order to preserve your line of credit for working capital. On the other hand, you may want to keep your line of credit “active” by using your line to acquire equipment. It is impossible to say which approach is best. A conversation with your banker certainly should be part of your decision-making process.

Michael P. Coyne is a founding partner of the law firm, Waldheger Coyne, located in Cleveland, Ohio. For more information on the firm, visit: www.healthlaw.com